It helps you track your real profits by considering all those hidden costs and fees that can eat into your revenue. When you know where every penny goes, you can truly celebrate your hard-earned profits. After watching this Jungle Scouts video, I see real potential for its Product Database, especially for sellers who don’t know what to sell. The database seems comprehensive but manageable enough that it stays user-friendly.

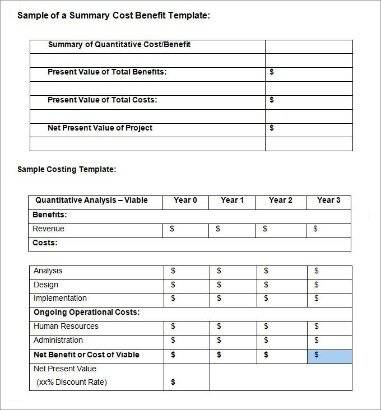

However, when it comes to taxes, it is generally better to be safe than sorry. Unlike your P&L and balance sheet, it is a more hands on report, where you can model best case, moderate, and worst-case scenarios. If you can figure out what caused the spike in sales, you can then double down on what’s working. In addition, here are a few accounting terms that it is important to know, as they’ll be referenced a bit in this guide.

Key Activities in Accounting for Amazon Sellers

The tool gives three different product listings, which works well. There aren’t too many listing variations to be overwhelming. You can use the tool to find high-potential products with low competition. It‘s ideal if you’re looking to extend your product offering.

With accurate accounting information, you can make strategic decisions about your business’s future. This includes planning for growth, identifying areas for cost savings, and making informed decisions about potential investments. Know your real-time financial situation to make data-driven decisions and solve problems proactively instead of reactively. At the end of the day, you don’t know how well something will do until you release it into the wild and see actual customer data.

- You get a dedicated bookkeeper to help you maintain your records, plus an optional accounting coach for a one-time fee.

- Like Nat, you can use AI to extract product reviews and use them as your VOC data.

- Perhaps most importantly, you’ll build business credit, which will provide funding advantages in the long term.

- With the number of new sellers entering into the marketplace year over year, competition is fierce.

Cloud accounting software, like Xero, is great at automatically syncing all of your bank transactions to your feed. However, occasionally one of your bank feeds might have an outage or some transactions go unaccounted for. We recommend that most businesses create cash flow forecasts at least once a quarter. You may want to do this more often if your business is prone to volatility or you are in uncertain times – like a global recession and pandemic. Here are some initial questions to ask when you are evaluating cloud accounting software. Online retail is fast and competitive, quick to change, and requires attention to detail.

A Detailed Guide to WooCommerce Accounting for eCommerce businesses

The biggest difference between fast-growing eCommerce businesses who are able to sustain that momentum for a long… As we alluded to above, top 25 small business tax deductions your first hire will most likely be an accountant followed by a bookkeeper. Every eCommerce entrepreneur has their own risk tolerance.

So, for educational purposes, I’ve hopped aboard the AI writing train. Like Nat, you can use AI to extract product reviews and use them as your VOC data. Once you have the data, you can segment it, find key trends, and create a plan to improve your product offering.

Manual accounting can be prone to errors, such as data entry mistakes. Automated accounting solutions reduce the risk of these errors, ensuring your financial records are accurate and reliable. This ongoing maintenance is essential for accurate financial management and early detection of any issues or discrepancies. A tax nexus is created when you have a physical presence in a state, such as a warehouse or an office. Failure to collect and remit sales tax can result in penalties and fines, so staying on top of your tax obligations is essential.

Amazon Accountant Bookkeeping

Jungle Scout is an excellent tool for in-depth product research. You can also access general market trends and specific seasonal shopping (think Halloween and Black Friday) insights. Adam recommends SellerApp as his top pick for “valuable insights and keyword optimization suggestions.” Like Helium 10, SellerApp comes with extensive tools for product research. Seelen recommends Helium 10 for keyword research and product trend analysis.

This matters because I want to see what pain points the product solves, what the results are, and where other products fail. Aside from this, Miletic uses AI to extract “product reviews from similar products.” This gives them insights on how to sell products more successfully. “We use this data to identify and compare the client’s strongest products and ones that need more boost to meet customer demands,” Miletic continues. This website is using a security service to protect itself from online attacks.

Creating your financial reporting systems

Whether all you need is your accounting done right or want guidance on planning for sales tax or understanding your product COGS, Seller Accountant has you covered on all fronts. ECommerce accounting is a necessary part of your business. Regularly reconcile your accounts, review your financial statements, and ensure everything is in shipshape. It’s like having a personal assistant that keeps your financial records in tip-top shape. It may be reflective of the way cash is moving through your business, but it does not accurately reflect the performance and profitability of your business. In addition, this method will show your inventory balance as zero.

Manage advertising, merchandising, and brand tools

I found registering for a Repricer account easy as they only required a few bits of information. But if you struggle, different help options are available on the setup screen. I may also look at a hybrid approach using real photos alongside an AI mock-up generator to show people using the products in different settings. I’d then use an AI tool to gather the best and worst customer reviews from the top five products.

Seller Accountant works exclusively with Quickbooks Online to give our clients the best bookkeeping experience possible. You should also have an ending inventory balance for each month. When you purchase inventory, the amount of inventory you purchased should be added to your inventory balance. Then, each month you subtract your COGS from your inventory to get a new inventory balance.